indiana state tax warrants

Indiana State Tax Information Support We will also notify the. Tax Warrants are issued by written letter never by telephone.

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

The Indiana Department of Revenue DOR has the right under certain parameters to issue a tax warrant.

. Find Criminal Warrants In Our Online Database. If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax.

Ad 2022 Official Updated Database -Find All Arrest Warrants for Anyone -All States Counties. These should not be confused with county tax sales or a federal tax lien. Allows for easy searching of taxpayers by name address warrant Saves you time paper and postage.

My pension is from a company based in another state. 218-2017 requires the department to publish the new rates effective July 1 2021 for the gasoline license tax IC 6-6-11-201 and special fuel license tax IC 6-6-25-28 on the departments Internet website no later than June 1 2021For the period July 1 2021 to June 30 2022 the following rates shall be in effect. A Tax Warrant is not an arrest warrant.

Indiana warrants can send you to jail or put you in front of a judge rather quickly. What can I do to be sure I am meeting all Indiana tax obligations for my business. Doxpop provides access to over current and historical tax warrants in Indiana counties.

Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property. If a person commits a crime fails to show to an appointed court date or even neglects to pay their child support a warrant could be issued for their arrest. Our service is available 24 hours a day 7 days a week from any location.

Almost one third of Indiana counties were processing tax warrants manually when this project started. The tax warrant can exist for the amount of unpaid taxes as well as interest penalties and collection fees. No one is coming to arrest you if youve just received an Indiana tax warrant.

March 18 2022 0013. Answered 4 years ago. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability.

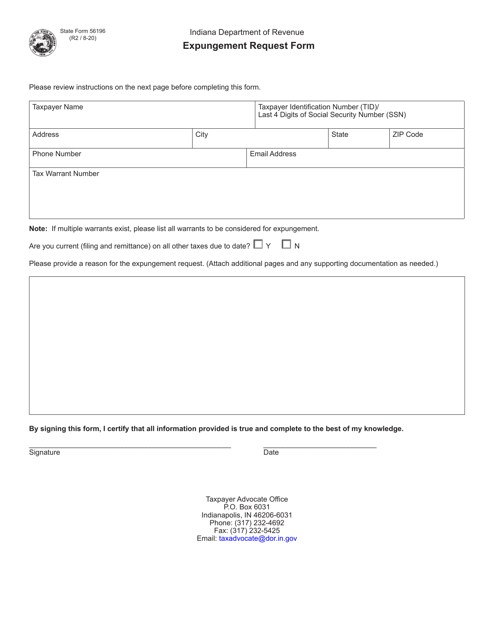

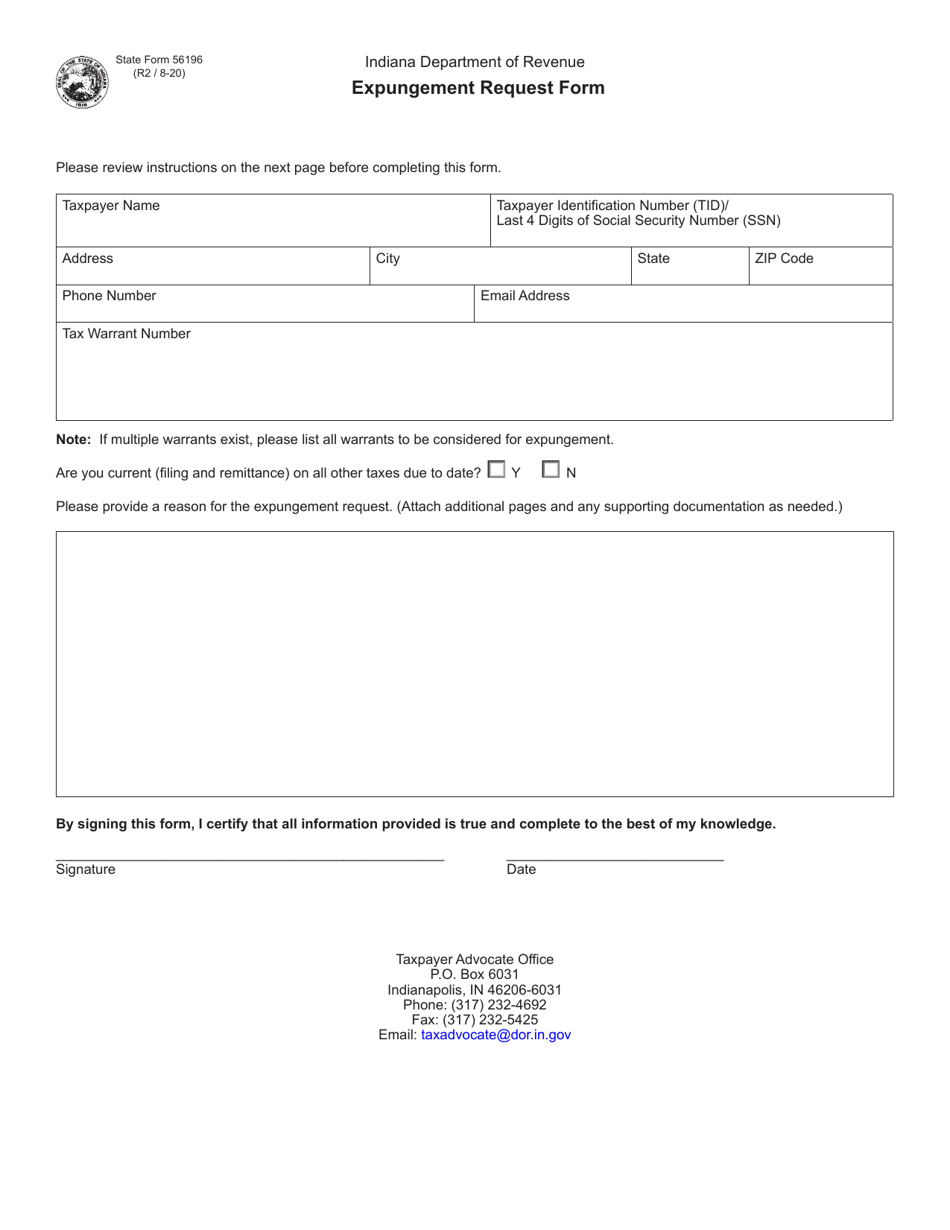

Pursuant to this law if an indictment is filed against a person and if he has not already been detained by the. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. However if your County Sheriff sets a timelocation for you to appear to discuss payment of your tax bill unless you have a discussion with their office and your presence isnt required you must attend and meet with your Sheriffs department about.

Find Anyones Active Criminal Warrant Records Online. It means that the state. Ad Get the Verified Answers You Need Now.

Tax warrants create liens against property to collect unpaid taxes income or otherwise and are filed by the Department of Revenue DOR in the county. Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and expunging the tax warrant may be in the best interest of the. A tax warrant is threatening legal action.

Tax warrant for collection of tax. If you receive a written Tax Warrant follow these. Increase in Gasoline License Tax and Special Fuel License Tax.

Ad You Can Now Find Warrant Records Online with a Simple Search. Instead this is a chance to make voluntary restitution for taxes owed. When you use one of these options include your county and the mandate number.

Grounds for indictment the importance of probable cause and the conditions for the issue of an arrest warrant are defined by section 35-33-2-1 of the Indiana Penal Code. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to. Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years.

Our information is updated as often as every ten minutes and is. Lives in Zionsville Indiana. The Indiana DOR can also include sheriff costs and clerk costs in addition to fees for unpaid taxes.

These taxes may be for individual income sales tax withholding or corporation liability. The DOR also sends the Clerk a check for 300 for each tax warrant filed. Keeps a constant history of all notes payments notifications sent.

About Doxpop Tax Warrants. Helps eliminate BAD ADDRESSES by sending them back to IDOR. Keeps a running balance of each warrants amount due.

Instantly Reveal Criminal Records Including Warrants DUI Traffic and More. What is a tax warrant. What is a tax warrant.

If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. Then I worked six months in another state. Implement the 25 Sheriff Process Fee for Tax Warrants.

The Indiana Department of Revenue first files a lien at the County Clerks Office then forwards a copy to this office. Just Enter a Name and State. The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana.

In Indiana a tax warrant is just another name for a tax bill. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Indiana Warrant Search Outstanding Active Warrants in IN.

That process begins when the DOR mails tax warrants to Clerks who hand write the information in a Judgment Book and mail back filing information to the DOR. Indiana State Tax Warrant Information. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

What state is it taxed in. Unfortunately Indiana warrants are necessary in order to hold people accountable for their actions. Get Verified Answers Today.

I worked in Indiana six months. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Tax Warrant for Collection of Tax.

To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue.

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Faqs Automated Tax Warrant System

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Dentons Indiana Tax Developments Fall 2020

Warrants Arrest Tax And Body Attachments Explained Carroll County Comet

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

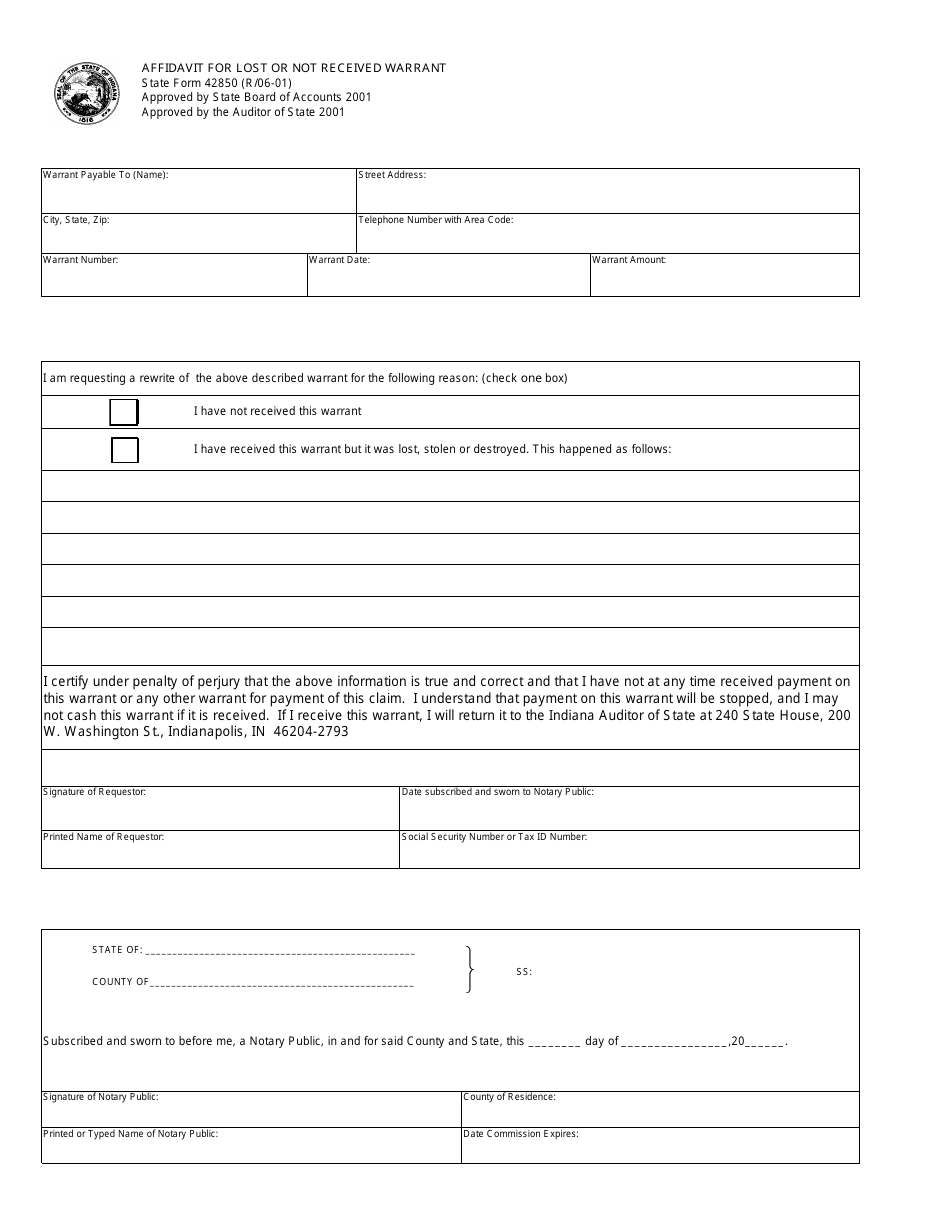

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant 2001 Templateroller

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly